Dear Traders,

Perhaps some of you have tried trading simple entries based on candlestick patterns like Pinbars for instance. I believe that most of these traders will sooner or later, realise the limitations of these simple signals.

Trading is not only about finding entries, nor is it only about analysing the price charts. It’s really about successfully combining both.

Today’s article explains this dynamic and how traders can apply it for their own trading.

Trading Signals and Entries are Limited

Over simplified entry techniques are alluring because they offer the sense that anyone can trade successfully within hours. The problem is that these signals are random and do not allow traders to really understand the price movement and chart patterns.

The signals might work well for a while but eventually the market dynamics will change and their entries will start to fail. Why? Because patterns form and break as the price waves and patterns of the market change.

In the meantime, signal traders will not understand why their entry signals are failing… They will keep trying the same method and hope that the ‘drawdown’ will soon end but in reality, the signals will not boost their accounts significantly.

How can traders solve this problem?

The solution is to implement a dynamic of analysis together with a trading system.

Why Analysis and Trading Systems are Critical

The trading plan should address all key parts of your trading, including:

- Analysis of the charts: trend direction and price patterns

- Trading system

- Entry and exit

Analysing the charts is the first important step. Traders need to review the charts based on sound and logical review of the trend and price patterns. This gives them an idea when, how, and where they want to trade.

The second step is the actual trading system. The importance of Forex Trading System is sometimes underestimated but adhering to clear set of rules is essentially to consistent profit taking.

Good trading systems (mostly) avoid entries when our analysis is incorrect and take entries when our analysis is correct. This way we stay on the right side of the market. A trading system without analysis leads to multiple dangers like over trading and revenge trading.

The third step is the exact entry and exit. This is when traders need to decide how they enter the markets. The system might confirm a long or short setup but this part of the trading plan explains how and when you can enter and exit.

Translating Analysis and Systems into Trading Decisions

Let’s use the EUR/USD as an example to underline the importance of this three step process.

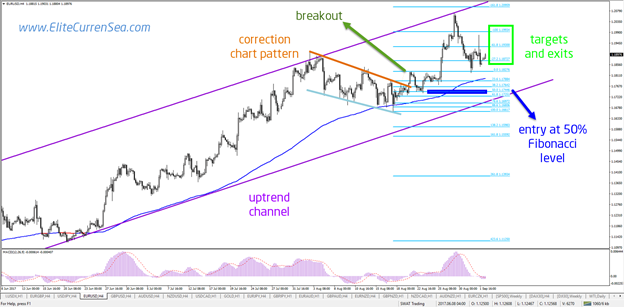

Analysis: the EUR/USD is in a strong Uptrend (purple lines). Price is moving in a bullish trend channel and it’s also above the long-term moving average. The price patterns are showing a corrective chart pattern (orange lines) called the bull flag, which is a trend continuation signal.

Trading system: there are many methods available but one of the most known ones is breakout trading. Here traders are looking for price to break above a trend line for instance. We will be looking for a candlestick that closes above the resistance trend line. When the break occurs, the trading system has been activated and you can look for an entry and exit.

Entry and exit: last but not least, it’s time for the actual signal. The entry could be based on multiple tools and indicators. One of the most famous tools is the Fibonacci indicator. Here is an example of an entry at the 50% Fibonacci retracement level and an exit at the Fibonacci target.

As you can see, the signal is the last part of the process, not the first and only one. Traders who only look at signals are trading in the dark. It is important to use analysis and a trading system to shine light on your trading.

Many green pips,

Chris Svorcik